Workforce demand will continue to be driven largely by the demand for replacement workers (workers retiring or otherwise leaving the workforce) over the next 10 years. This has significant implications for the workforce system as a whole and will drive the responses of education and training programs as well as institutions and employers alike.

Overall Business Demand by Industry Sector

In 2024 there were a total of 147,407 jobs (compared to 139,881 in 2019) in the NWDB region. In the past five years, the region has experienced an overall decrease in unemployment, similar to decreases in unemployment in Maine and the US.

Over the next ten years, the NWDB region is projected to experience a 0.1% annual decrease in total employment. However, there will still be a need for workforce development resulting from replacement demand (demand resulting from retirements and individuals leaving the workforce), which will create the need to fill 158,111 jobs over the course of the next ten years.

Health Care & Social Assistance, along with Retail Trade, are the two largest industries within the NWDB region, providing over 27,679 jobs and nearly 21,160 jobs, respectively. Health Care and Social Assistance is projected to grow at an average annual growth rate of 0.5% which is the only major industry class projected to grow. Other industries that represent considerable portions of jobs in the region include: Educational Services (16,109 jobs), Accommodation and Food Services (12,807 jobs), Construction (10,165 jobs), and Manufacturing (8,759 jobs).

Retail, though the second largest sector, is projected to decline by more than 0.8% jobs and pays lower than average annual wages. It therefore may not be a strong sector to target. Additionally, the sector is experiencing recent and projected future transformations, including digital technologies and reduction of big box, brick and mortar stores making it susceptible to further employment declines.

Health Care and Social Assistance, along with Retail Trade industries have a location quotient (LQ-measure of the degree to which a region has a concentration in an industry) of 1.25 and 1.47, respectively showing these industries are slightly more concentrated in the NWDB region compared to the United States. Other industries in which the NWDB region exhibits a greater than average concentration (above average LQ) include Education Services (1.36), Management of Companies and Enterprises (1.28), and Construction (1.15).

Note: a LQ of 1.0 indicates equal concentration to the U.S. as a whole, with greater numbers indicating a higher concentration and lower numbers indicating a lower concentration.

Based on a combination of existing employment, projected employment, replacement demand, and industry concentration, the key industries for future workforce demand in the region are:

• Healthcare & Social Assistance

• Retail Trade

• Accommodation & Food Services

• Educational Services

• Construction

• Manufacturing

Self-Employment & Emerging Sectors

In addition to the traditional industry alignment in the region, the NWDB region has a vital entrepreneurial sector of an estimated 10,305 total self-employed individuals, which represents approximately 7% of total jobs, making self-employment a group among the top five industry sector groupings in terms of size. These individuals earn an average $42,033 annually. Within the entire NWDB region, the industries with the most self-employed individuals are in Construction with 2,366 self-employed and Agriculture, Forestry, Fishing and Hunting with 1,984 self-employed. Other Services (except Public Administration) is next, with 836 self-employed.

Overall, within the NWDB region, Agriculture, Forestry, Fishing and Hunting self-employed have an average annual wage of about $57,007, whereas self-employed individuals within the Construction industry see a much lower average annual wage at $37,593.

Emerging industries will continue to play an important role in shaping workforce development strategies across the NWDB region. Clean energy, in particular, is a growing field with strong long-term potential. The State of Maine projects the creation of 30,000 new clean energy jobs by 2030, with solar and wind technician roles among the fastest-growing occupations nationally. As demand for skilled workers in this sector increases, NWDB anticipates new opportunities to collaborate with education providers and employers to develop training programs that prepare local job seekers for careers in renewable energy, energy efficiency, and related fields. These efforts will help connect workers to stable, future-focused employment while supporting broader economic and environmental goals.

It is critical that the regional workforce strategies include the development of partnerships and collaborations for provision of technical assistance, information, programs, and services to support these entrepreneurship and business/job creation opportunities.

Occupations & Employment Demand

In terms of occupations, of the region’s 147,407 jobs, Office and Administrative Support have the highest number of jobs with 15,869. This is followed by Sales and Related with 13,693, Food Preparation and Serving with 12,260, Transportation and Material Moving with 11,949, Management with 11,155, Healthcare Practitioner and Technical with 10,723, and Educational Instruction and Library with 10,521.

Growth in occupational demand due to industry growth (new jobs) in the next ten years is projected to be driven by healthcare occupations and to occur with the occupations of Healthcare Support (704 jobs) followed by Community and Social Service (271 jobs). Other occupations with projected growth are Educational Instruction and Library (274), Management (256), Computer and Mathematical (110), Construction and Extraction (105), Personal Care and Service (80), Business and Financial Operations (69), Life, Physical, and Social Science (57), Architecture and Engineering (32). All other sectors are expected to retract.

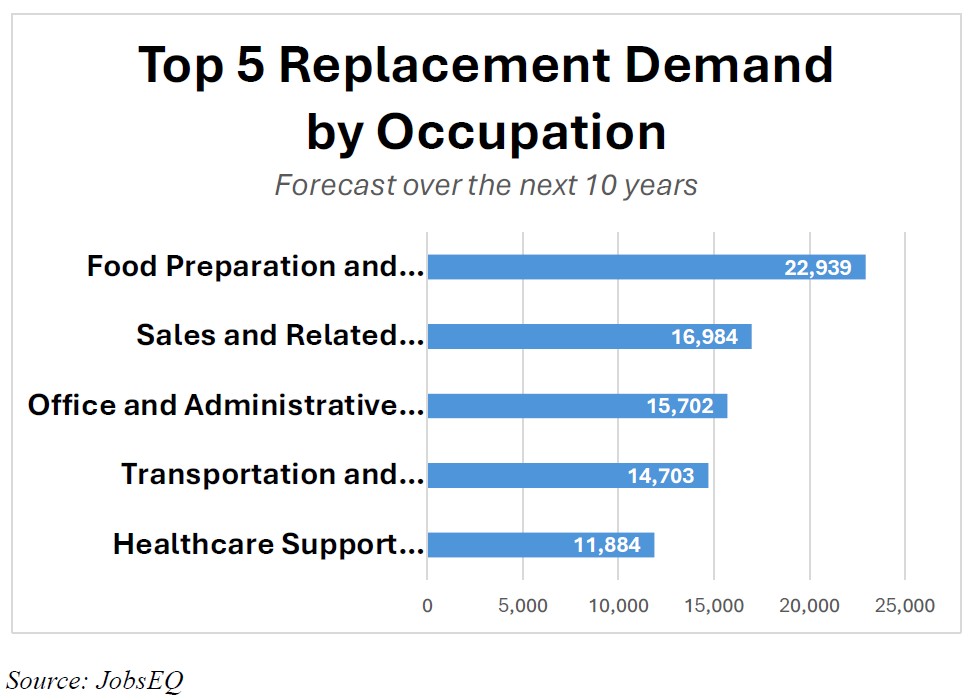

As depicted in the chart below it is projected that replacement demand will drive the need for 160,849 at positions with the highest occupations being Food Preparation and Serving (22,983 jobs), Sales and Related Occupations (16,984 jobs), Office and Administrative Support (15,702 jobs), Transportation and Material Moving (14,703 jobs), and Healthcare Support Occupations (11,884). Regional workforce strategies should include information, programs, and services to support industry and interested job applicants, both employed and underemployed, in filling this replacement demand.

Targeted Industry Sector Based on Employer Demand

Analysis of regional employment, wage, and occupational data highlights several key industries that are driving workforce demand across the NWDB region. These industries play a significant role in overall employment levels, offer opportunities for wage growth, or face urgent workforce needs due to projected retirements and replacement demand.

Based on this data, the industries with the greatest impact on job creation, retention, and workforce planning include:

• Healthcare & Social Assistance

• Manufacturing

• Construction

• Accommodation & Food Services

• Retail Trade

• Educational Services

• Transportation & Warehousing

• Administrative & Support Services

• Professional, Scientific, & Technical Services

NWDB has identified Healthcare, Manufacturing, and Technology as its top three priority sectors for targeted workforce strategies. These sectors demonstrate strong employer demand, high levels of replacement need, and a mix of accessible and high-wage job opportunities.

In addition to these primary focus areas, NWDB and its partners will continue to support workforce initiatives in Transportation and Agriculture, Forestry, Fishing, and Hunting, where self-employment and replacement needs also play a vital role in the regional economy.

These industry priorities will guide program development, training investments, and employer engagement efforts to ensure that the region’s workforce is equipped to meet both current and future job demands.